estate tax return due date canada

31 rows A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. For a T3 return your filing due date depends on the trusts tax year-end.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

For example if the estate is wound up and.

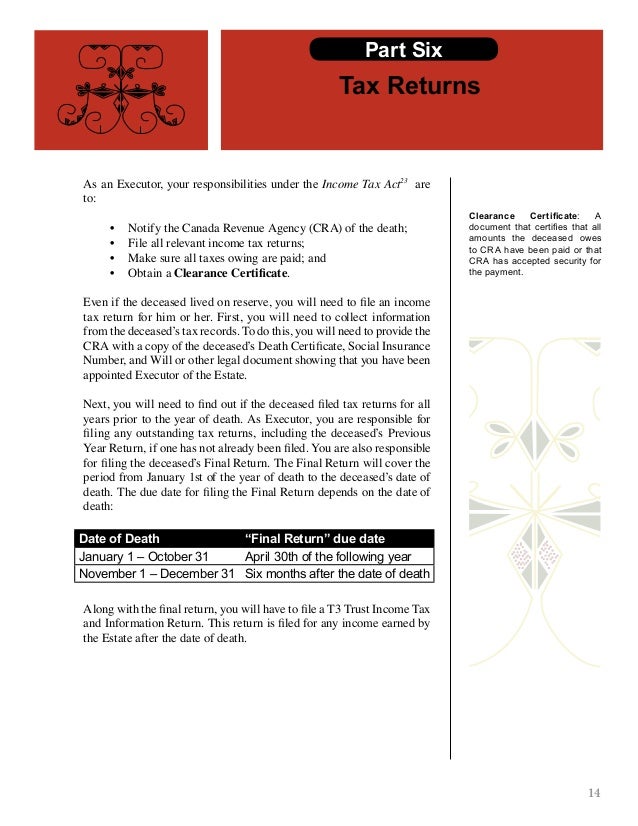

. Before distributing assets they must complete the following steps to obtain a clearance certificate. The day after the passing of the testator results in the creation of a new person in the eyes of Canada Revenue Agency. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension.

In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later. For a T3 return your filing due date depends on the trusts tax year-end. Find out more about final returns inheriting property and more.

If the death occurred between january 1 and october 31 inclusive the due date for the final return is april 30 of the following year. 1- Notify the Canada Revenue Agency of the death. First there are taxes on income or on.

9000 4000 5000. Unlike the filings of the year preceding death. If you fail to file the T3 return by the due date you will be subject to a penalty.

To calculate the amount of Estate Administration Tax the estate owes use the tax calculator. The balance-due date for the 2017 tax year is April 30 2018 and one year after that date is April 30 2019. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross.

From the readjusted balance subtract all capital gains deductions claimed to date. Final return For a graduated rate estate you. If you applied for an estate certificate before January 1 2020 the tax rates are.

13 rows Only about one in twelve estate income tax returns are due on April 15. For more information go to Guide T4013 T3 Trust Guide. Filing dates for 2021 taxes.

Deadline to file your. The date that is 90 days after the assessment date is August 30 2018. There is no inheritance tax in Canada but the estate will still need to pay taxes that the deceased owes.

This return is due at the same time as the terminal tax return. If the death occurred between November 1 and December 31. Postmedia Network Inc.

Report income earned after the date of death on a T3 Trust. The gift tax return is due on April 15th. You can use 5000 to reduce the deceaseds other income for 2021.

365 Bloor Street East Toronto Ontario M4W 3L4 416-383-2300. The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the final return. 31 as the estate yearend and files.

If the death occurred between January 1 and October 31 inclusive the due date for the final return is April 30 of the following year. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death. Apr 30 2022 May 2 2022 since April 30 is a Saturday.

If Rita chooses Dec. Deadline to contribute to an RRSP a PRPP or an SPP. 2- File the necessary.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. The types of taxes a deceased taxpayers estate. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will.

The estate T3 tax return reports income earned after death.

Canadian Estate Cost Calculator

Instructions For Form 1040 Nr 2021 Internal Revenue Service

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

How Estate And Inheritance Taxes Work In Canada

2020 Tax Filing Due Dates Thompson Greenspon Cpa

Wills Estates Book Two Final Final Final

Estate Taxes What Should You Pay After Death In Canada National Bank

How To Successfully Retire In The United States As A Canadian Expat

Emancipation Day Delays Tax Return Filing Due Date Wolters Kluwer

How To File Income Tax In France A Guide For Expats Expatica

Exploring The Estate Tax Part 1 Journal Of Accountancy

I Haven T Filed Taxes In 5 Years How Do I Start

What Are Marriage Penalties And Bonuses Tax Policy Center

Taxprep Canadian Tax Compliance Software For T1 Tp1 T2 And T3 Industry Leading Wolters Kluwer

Tax Return United Kingdom Wikipedia

Canada Revenue Agency Wikipedia

Canada Taxation Of International Executives Kpmg Global

What To Know About Covid 19 And Taxes Deadline Delays The Cares Act And More