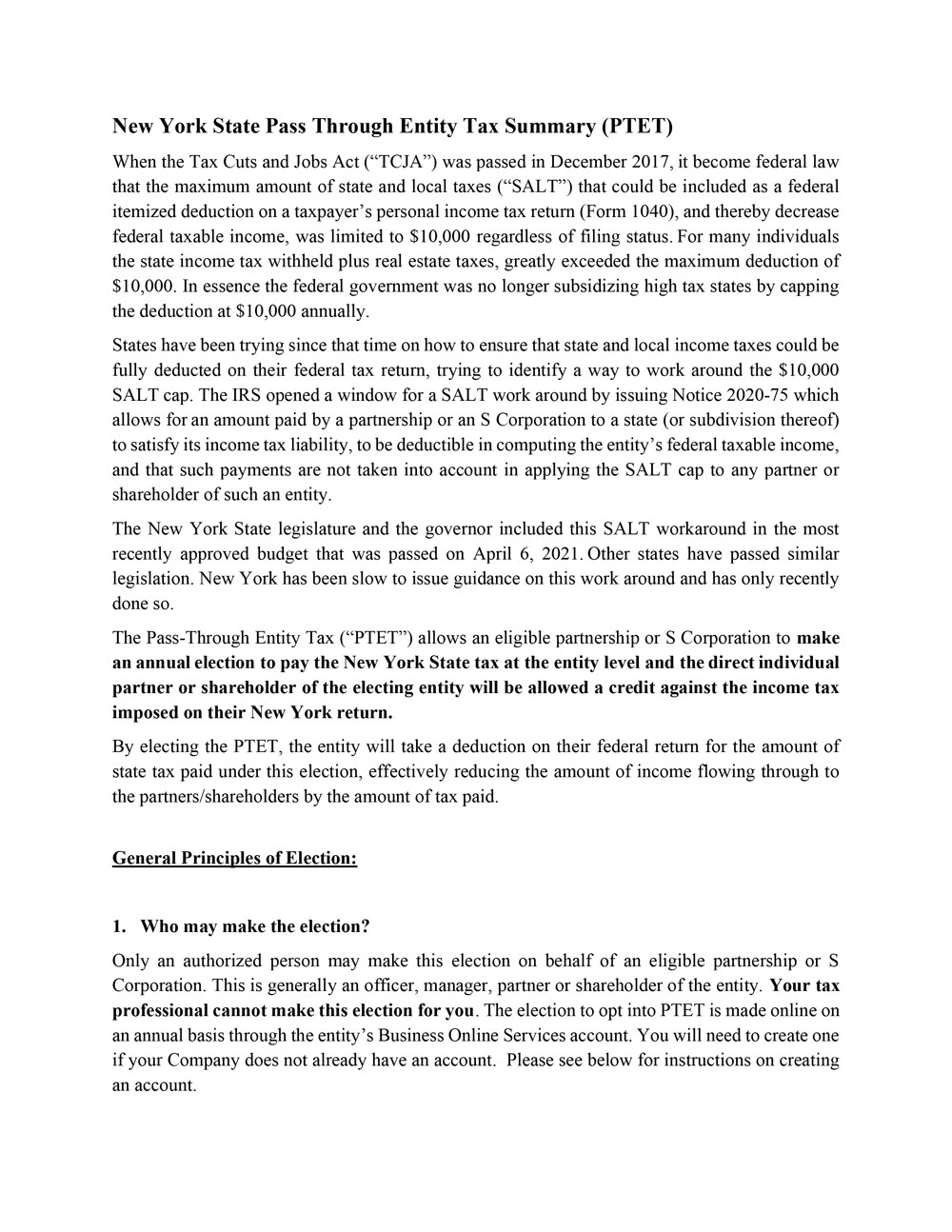

flow through entity tax break

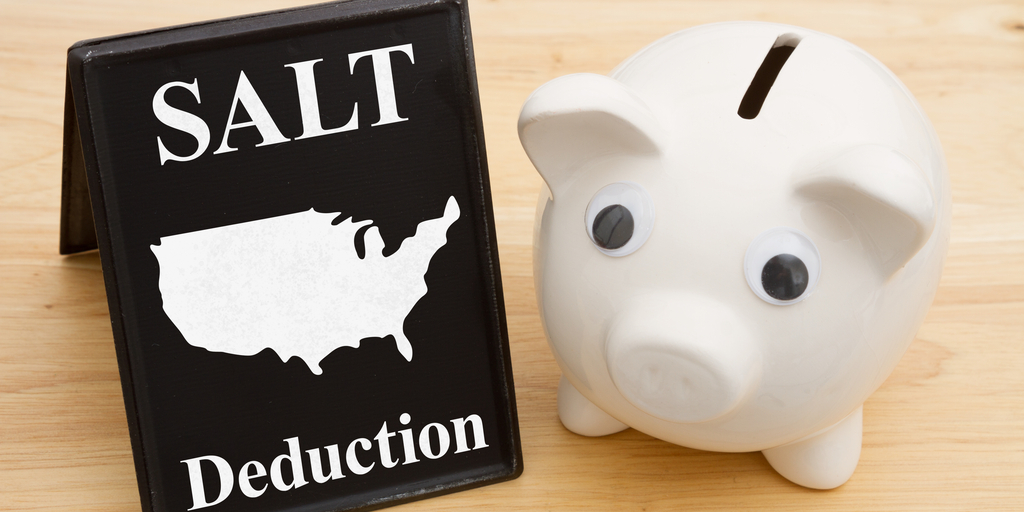

The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under. A business owned and operated by a single individual.

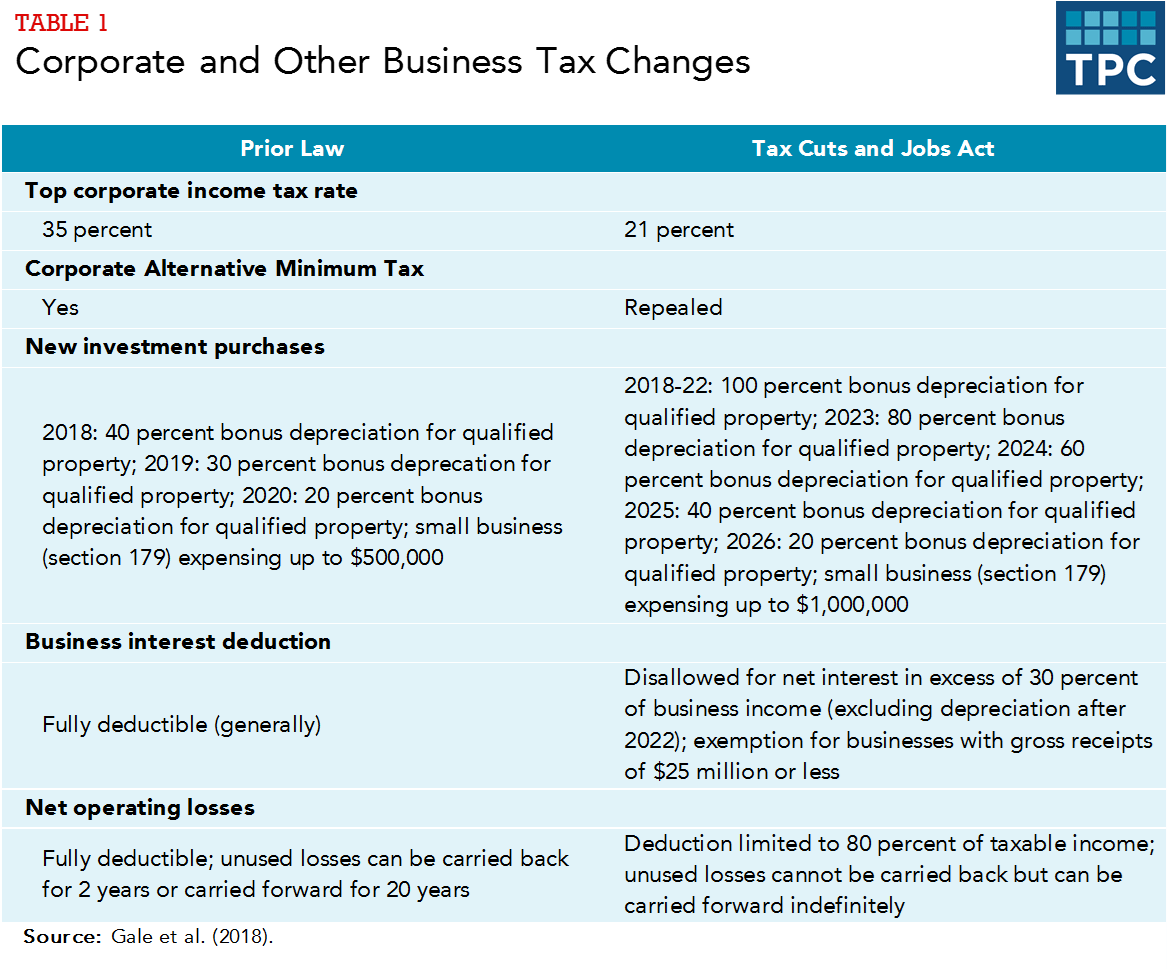

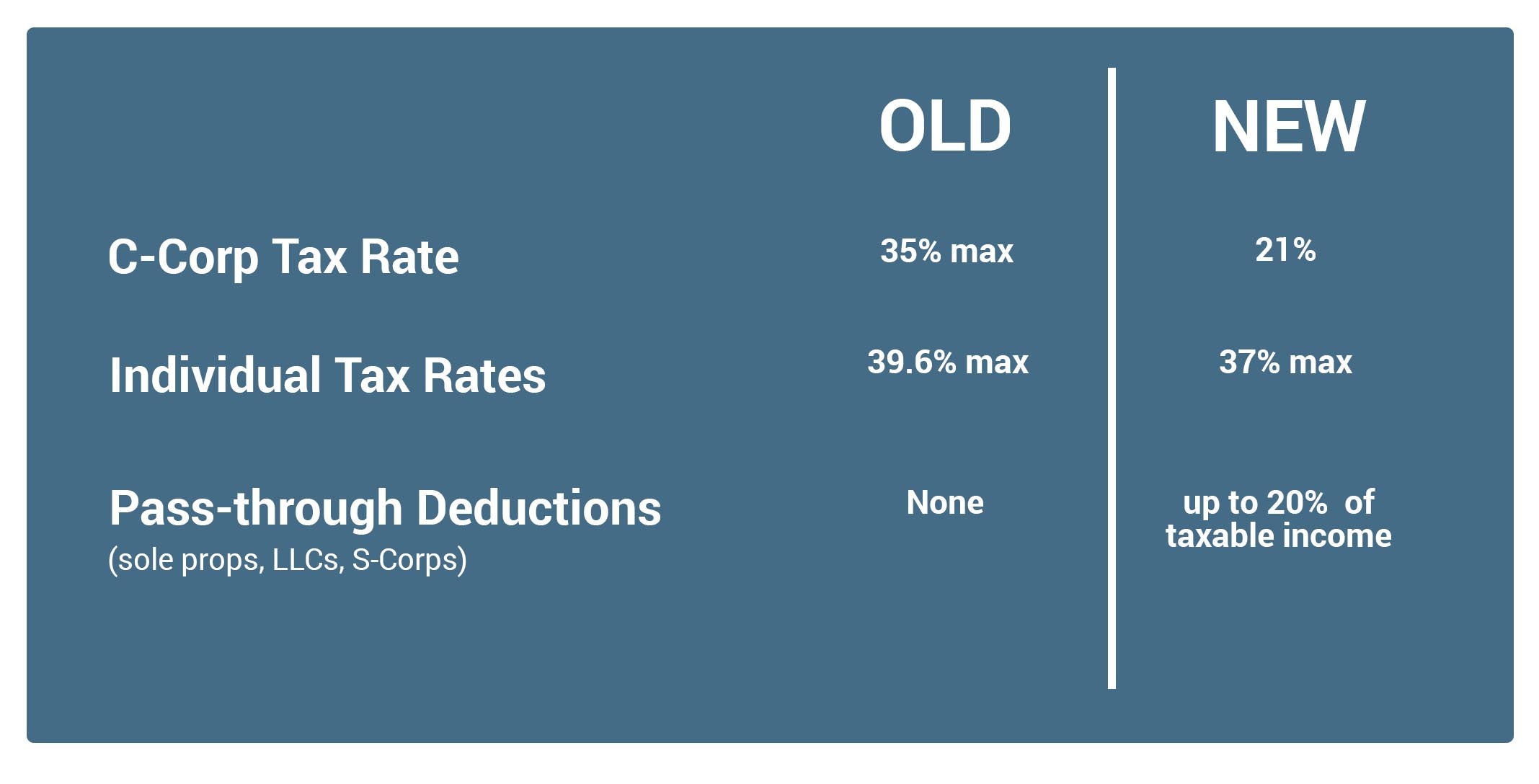

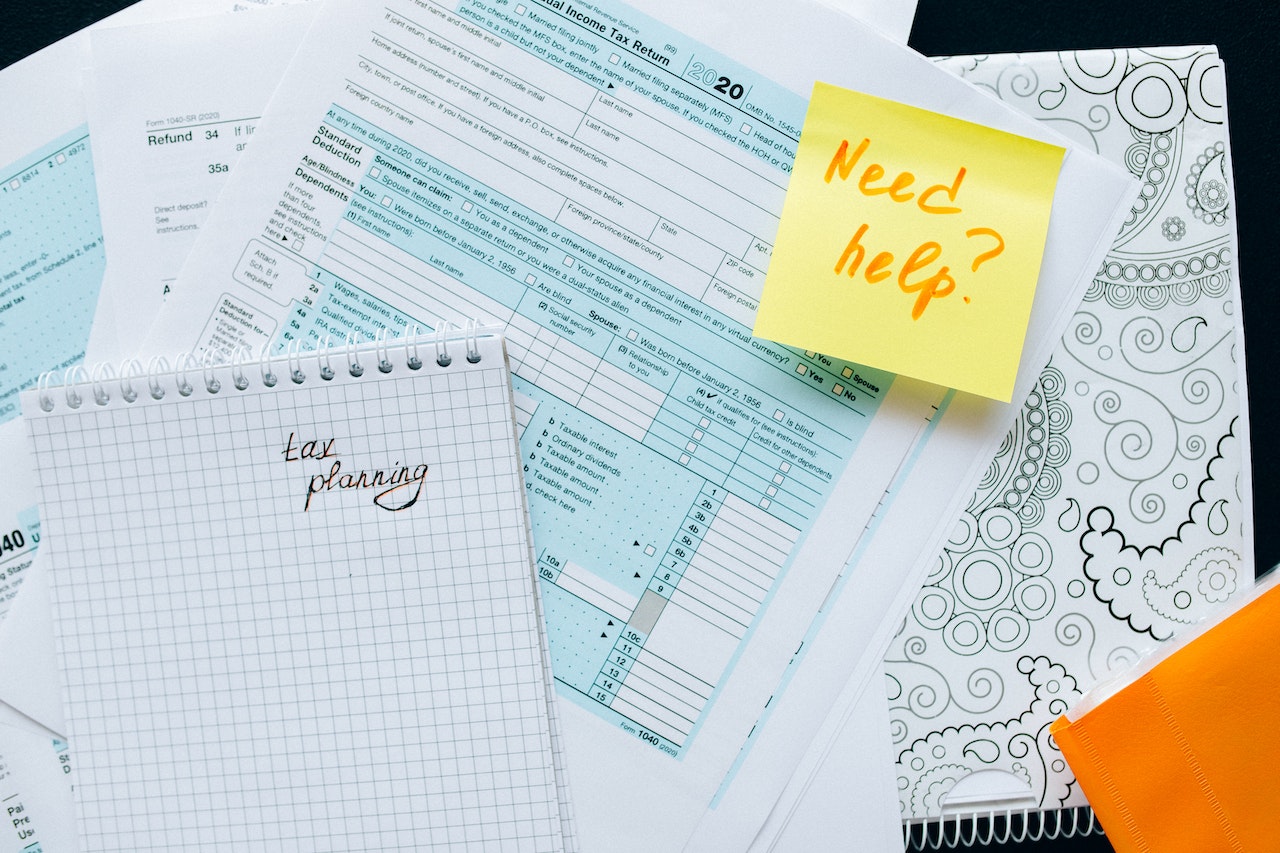

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

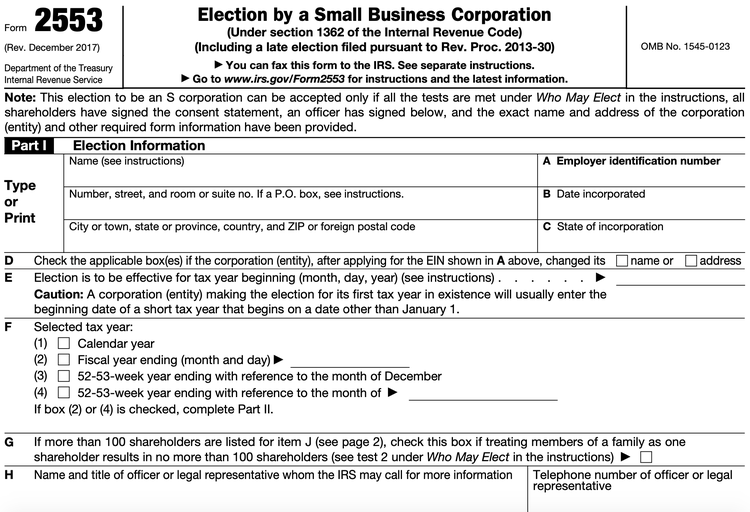

5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

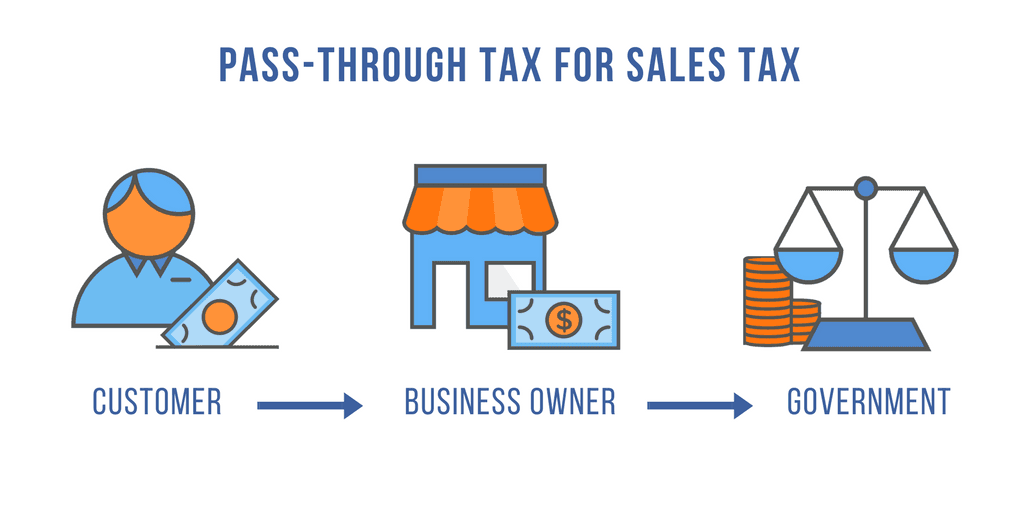

. Is elected and levied on the Michigan portion of the. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan.

If signed into law HB 5376 will create an optional entity-level tax which flow-through entities could pay instead of the individual state income tax. Understanding What a Flow-Through Entity Is. There are three main types of flow-through entities.

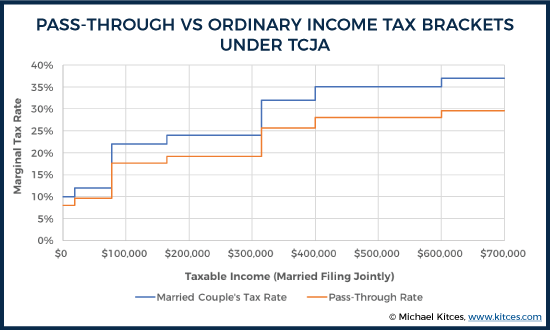

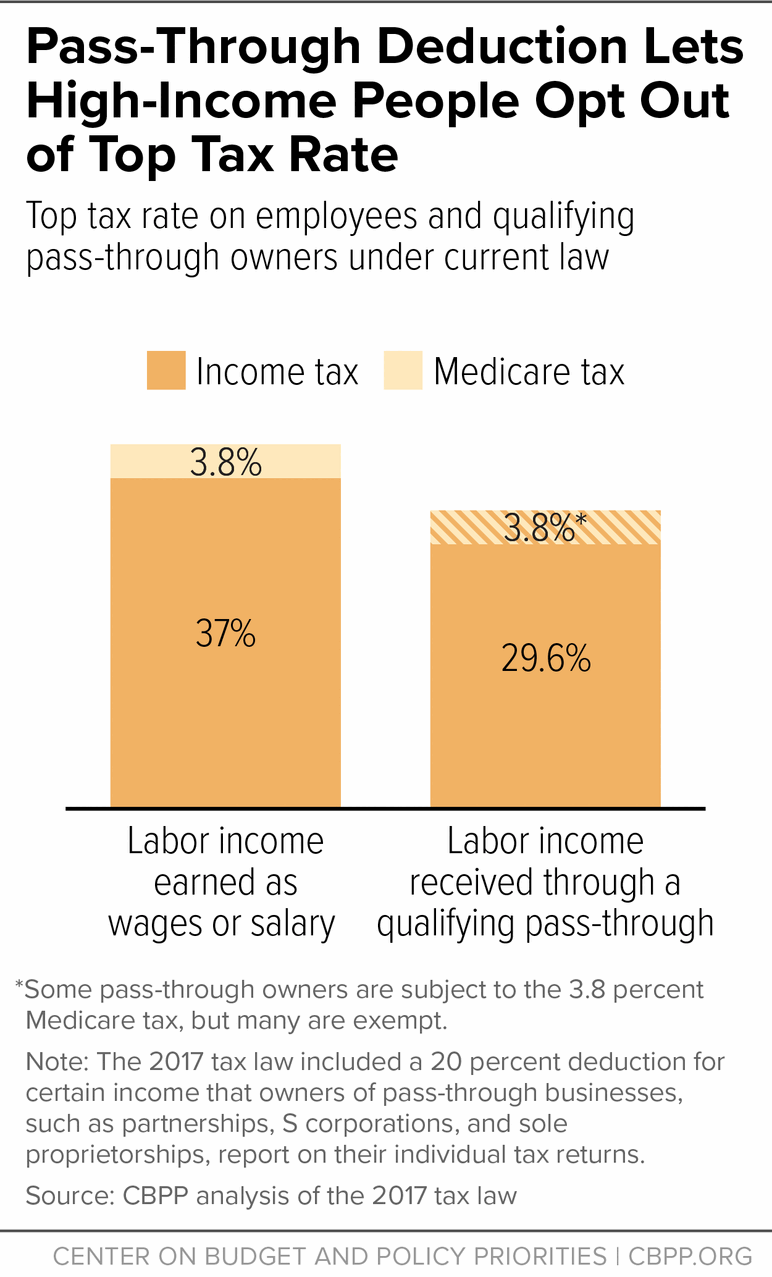

There are two major reasons why owners choose a flow-through entity. The Act provides a significant tax break to owners of flow through entities S corporations and partnerships. However the late filing of 2021 FTE returns will be.

Flow-through entities are considered to be pass-through entities. Governor Whitmer signed HB. Types of flow-through entities.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. A flow-through entity FTE is a legal entity where income flows through to investors or owners. This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the.

Under the new tax the. 20 PA 135 of 2021 amends the state Income Tax Act to create a flow-through entity tax in Michigan. According to Crains Chicago a rough estimate of tax savings to affected.

The law signed by Whitmer on Dec. The entitys income only goes through a. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a.

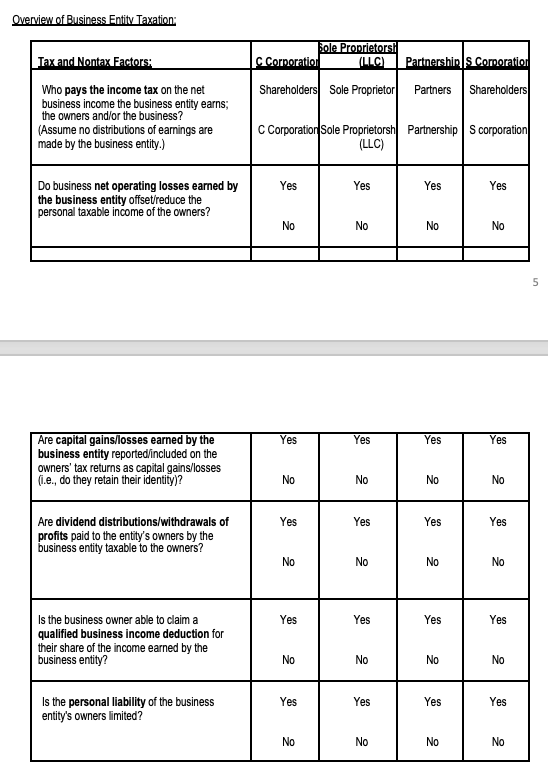

This legislation was passed as a. Nearly 3 million more business owners claimed a 20 tax deduction on their income last year relative to the prior filing season according to IRS data. That is the income of the entity is treated as the income of the investors or owners.

Most small businessesand quite a few larger onesare set up as pass-through entities. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. A flow-through entity is also called a pass-through entity.

This means that the flow-through entity is responsible. Advantages of a Flow-Through Entity.

Traverse City Business News Michigan Flow Through Entity Tax The State And Local Tax Workaround

Pass Through Entity Tax Ptet Salt Deduction Workaround Longer Version Youtube

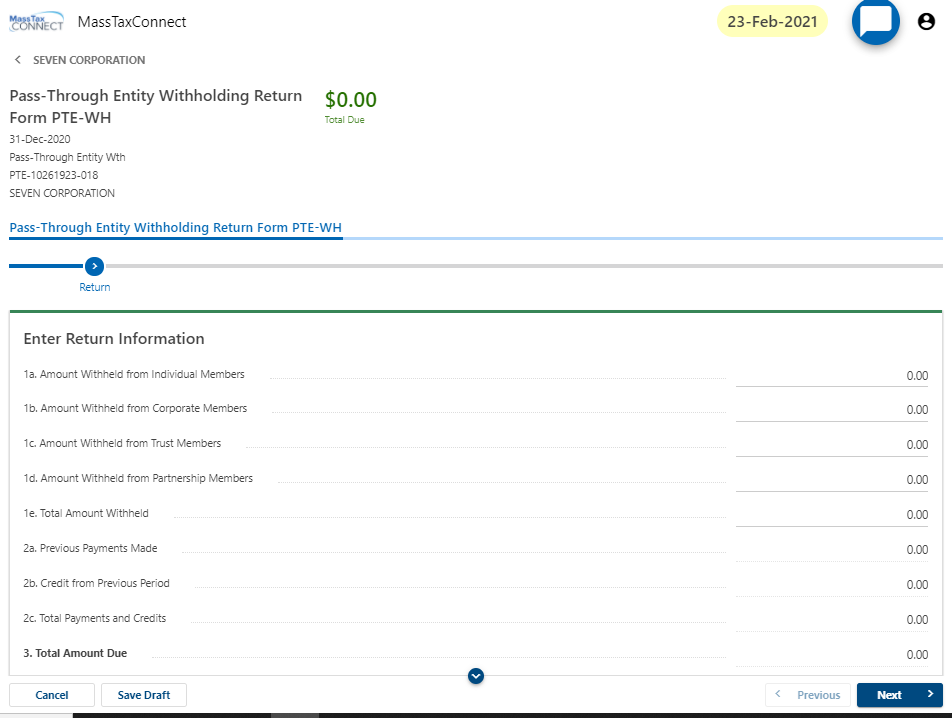

Tax Guide For Pass Through Entities Mass Gov

Repealing Flawed Pass Through Deduction Should Be Part Of Recovery Legislation Center On Budget And Policy Priorities

Impact Of 2018 Tax Reform On Corporations Pass Through Entities

Pass Through Taxation What Small Business Owners Need To Know

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

Minnesota S New Pass Through Entity Pte Tax A Salt Cap Workaround For Business Owners Lawyer Wayzata Legal

Michigan Salt Workaround Flow Through Entity Tax Iannuzzi Manetta

A Beginner S Guide To Pass Through Entities

New York State Pass Through Entity Tax Welker Mojsej Delvecchio

Picpa Committee To Vote On Pass Through Entity Tax House Bill 1709 Wilke Associates Cpas

Maryland Relief Act Makes Changes To New Pass Through Entity Tax Uhy

Flow Through Entity Example Chantelle Larry Chegg Com

Michigan Fte Tax Return Format Available Clayton Mckervey

Repealing Flawed Pass Through Deduction Should Be Part Of Recovery Legislation Center On Budget And Policy Priorities

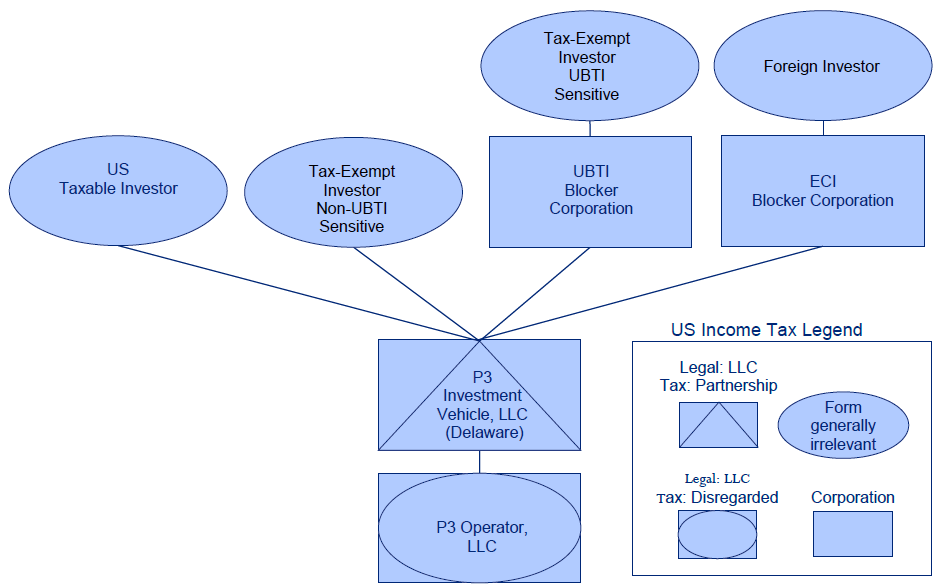

Fhwa Center For Innovative Finance Support P3 Toolkit Publications Reports And Discussion Papers

How Does A State Pass Through Entity Tax Deduction Affect Owners Tax Returns Our Insights Plante Moran